Being outstanding at delivering the products and services your business is known for is great – but it’s only part of the picture. The future health and growth of your business depends on making smart decisions based on solid information.

To drive your business forward, you will need to:

- Have a plan. Whether it’s to dominate the market in your country or simply become the preferred supplier in your town, if you don’t have a plan you don’t know where you’re trying to go.

- Have measurable goals and objectives. Your “big picture” plan is one thing; but you need to set out the steps you’ll take to get there.

- Build a strategy. Now that you’ve got goals, you can decide exactly what you need to do to achieve them.

- Define your tactics. These are the day to day activities that contribute to your strategy, goals and big picture plan.

Why are KPIs Important to Business Strategy?

KPIs can give you a valuable insight into the day-to-day performance of your business. KPIs such as cash flow and outstanding revenue can give you a snapshot of where your business “is” right now.

But while these kinds of KPIs are certainly useful and may help you make better business decisions, you also want to see the bigger picture and look at your long-term performance.

Such metrics will help you evaluate:

● Areas of your business which need to be improved

● Strategies that are succeeding or failing

● Whether you are on target to meet your goals

● What opportunities you have for further growth and what challenges you face

The 5 KPIs You Should Watch to Inform Your Business Strategy

The exact KPIs that matter most to your business will depend on a range of factors, including the industry you are in and what goals you have set. However, here are 5 KPIs every business should be closely monitoring:

KPI 1 – REVENUE GROWTH

Revenue is the life-blood of any business. If your revenue is growing there’s a good chance your business is doing well. If it is falling, then it might be a sign that your products and services are no longer relevant to your clients’ needs.

To calculate revenue growth track your sales from one reporting period to the next. Deduct the previous period’s revenue from the current period and divide the resulting figure by the last period’s revenue. This will give you your revenue growth as a percentage.

KPI 2 – INCOME SOURCES

Analyzing your income sources – your revenue per client and per product or service – will help you to identify your most, and least, profitable clients and products. In turn, this will enable you to spot opportunities for up-selling and cross-selling, and, sometimes, tell you which lines and clients should be cut from your business.

KPI 3 – REVENUE CONCENTRATION

Having the majority of your income coming from a small concentration of clients can potentially put your business at huge risk. If you lose even one or two major clients it could be disastrous for your revenue.

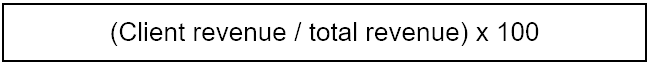

You can identify how much each of your clients contributes to your total revenue using the following formula:

This formula will show you the percentage of total revenue coming from any given client. If you notice that a small group of clients are contributing the bulk of your revenue you may wish to take steps to diversify your income sources and reduce your exposure to risk.

KPI 4 – PROFITABILITY OVER TIME

We looked in a previous article at compiling profit & loss statements, where revenue is compared to expenses. Tracking these reports over time will show you if there are trends in your profitability that require attention.

For example, falling profits over time may indicate that you need to reduce your costs. Conversely, they may mean that you are not selling at sufficiently high prices, or selling enough units. A deeper look at profitability over time will give you clues as to where the opportunities are for improvement.

KPI 5 – WORKING CAPITAL

Planning ahead, and in particular being able to take advantage of opportunities which may present themselves at short notice is a key part of growing a business successfully; and this means keeping a close eye on your working capital.

Working capital is that which you might get by way of a loan from the bank (or even family members) to help fund your day-to-day business. It can also serve as a buffer when cash flow is slow, perhaps because clients are late in paying invoices or you’ve had to make a big cash outlay for a new project.

To calculate your working capital, simply subtract your current liabilities from your current assets. If assets are greater than liabilities, then you have positive working capital.

You can also divide current assets by current liabilities to calculate your Working Capital Ratio. A healthy ratio will be between 1.2 and 2.

Billwaze

Billwaze