We looked in a previous article at the methods used to calculate Cost of Good Sold. FIFO and LIFO are two ways of determining that cost.

FIFO (First In, First Out) calculates Cost of Goods Sold on the basis that a business’s oldest inventory items are sold first. LIFO (Last In, First Out) on the other hand, uses the production costs associated with a business’s newest inventory.

FIFO vs LIFO – What’s the Difference?

The difference between FIFO and LIFO is purely theoretical. Since neither method actually involves tracking of incoming and outgoing inventory, the method chosen depends on an assumption of the order in which inventory is sold.

However, since Cost of Goods Sold has an impact on profits, and therefore taxes, it is important though that inventory is sold in the intended order, in order for Cost of Goods Sold to be accurately calculated.

FIFO vs LIFO – Which is Best?

Under normal conditions, FIFO is taken to be the more reliable and accurate way of determining Cost of Goods Sold. It is far more common for businesses to use their oldest inventory first – it ensures that inventory doesn’t become obsolete or lose too much value through depreciation. By using this practice to calculate Cost of Goods Sold, it is easier to eliminate errors in reporting.

LIFO does have its advantages from an accounting perspective. As costs typically rise over time due to inflation, using LIFO allows a business to report higher costs, and therefore lower profits and taxes. However, while lower taxes may be desirable, reporting lower profitability can impact negatively on how the financial health of the business is perceived by potential investors.

In addition, switching to LIFO (and correctly using the most recent inventory first) can result in older inventory never being used and therefore no longer reflecting its true market value.

Since LIFO also allows for financial statements to be more easily manipulated, FIFO is considered the best practice method of calculating Cost of Goods Sold.

How are FIFO and LIFO Calculated?

Multiplying the cost of a business’s oldest inventory by the amount of inventory sold will give the Cost of Goods Sold figure according to the FIFO method.

Conversely, multiplying the cost of a business’s newest inventory by the amount of inventory sold will give COGS by the LIFO method.

FIFO vs LIFO – a “Real World” Example

Bob’s Hardware Stores has been doing great business with their new range of ladders. Unfortunately, the cost of the ladders has increased gradually over the course of a year – but to stay competitive, Bob has chosen not to increase his selling price.

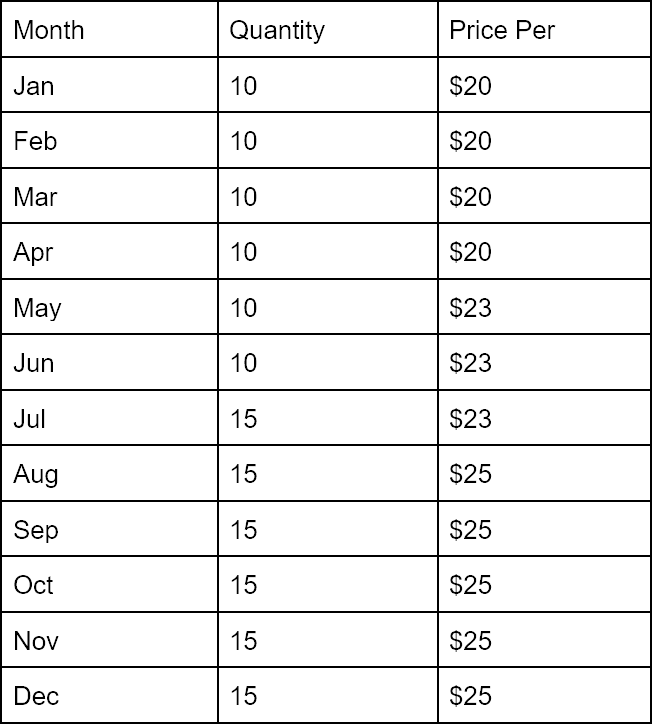

Here’s the inventory Bob has purchased over the course of the year:

Over the course of the year, Bob has bought 120 ladders into his inventory. In the same period he has sold 90 ladders.

Cost of Goods Sold Using FIFO

Bob calculates his Cost of Goods sold using the costs of the oldest 90 ladders sold. These costs are:

● 40 @ $20 = $800

● 35 @ $23 = $805

● 15 @ $25 = $375

Bob’s Cost of Goods Sold comes to $1,980

Cost of Goods Sold Using LIFO

Bob calculates his Cost of Goods sold using the costs of the newest 90 ladders sold. These costs are:

● 75 @ $25 = $1,875

● 15 @ $23 = $345

Bob’s Cost of Goods Sold comes to $2,220

As we described earlier, the LIFO method returns a higher Cost of Goods Sold, resulting in less profit and a lower tax obligation.

The difference between the two figures – $240 – is known as the LIFO Reserve.

Is LIFO Permissible Under GAAP?

GAAP, the Generally Accepted Accounting Principles, are the standard operating procedures for accounting in the USA. Within the United States, LIFO is allowed as a method of calculating Cost of Goods Sold. However, outside of the USA it is not permitted, and so you may see some American companies using both methods depending upon where they are filing their accounts.

Outside of the US it is more common for businesses to follow the guidelines set out by the International Financial Reporting Foundation (IFRS).

Billwaze

Billwaze