Billwaze

Billwaze

Jeff Liebov is the CEO & Founder of BILLWAZE. Jeff envisioned a simpler way out of the complicated world of accounting apps and created BILLWAZE. As a tool, BILLWAZE makes things easy for those who want to get things done fast, without all the hassle. Jeff and the team are continuously improving the platform and are passionate about making the entire billing process simpler than ever.

Relevant Blog

How To Calculate Straight Line Depreciation

Published on April 10, 2023 by Stephanie MilneThe moment you purchase something, its value begins to decrease. In accounting terms this is called depreciation, and it is crucial in determining the value of your business’s assets. Straight Line depreciation is the most common form of calculating the depreciation of an asset’s value over the course of its life. Very simply, each accounting […]

Let’s take a look at an example to put these numbers into context…

Bob’s Hardware Store is considering adding a new line of ladders to their offering. Demand for ladders seems to be increasing in the area and Bob wonders if the new ladders he’s seen could help boost their profits.

Let’s take a look at an example to put these numbers into context…

Bob’s Hardware Store is considering adding a new line of ladders to their offering. Demand for ladders seems to be increasing in the area and Bob wonders if the new ladders he’s seen could help boost their profits.

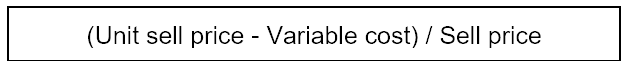

The Contribution Margin of Bob’s new ladders is ($45 – $20) / $45 = $0.56.

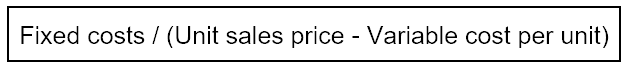

The equation to calculate the break-even point in Dollars is:

The Contribution Margin of Bob’s new ladders is ($45 – $20) / $45 = $0.56.

The equation to calculate the break-even point in Dollars is:

So in Dollar terms, Bob’s break-even point is $2,500 / $0.56 = $4,464. That’s the revenue Bob needs to generate to break even with the new ladders.

Allowing for rounding up and down, we can see that this number compares directly to the 100 ladders @ $45 Bob needs to sell.

So in Dollar terms, Bob’s break-even point is $2,500 / $0.56 = $4,464. That’s the revenue Bob needs to generate to break even with the new ladders.

Allowing for rounding up and down, we can see that this number compares directly to the 100 ladders @ $45 Bob needs to sell.