Devaluation is the value of an asset to a business over the useful lifetime of that asset. There are three ways to calculate depreciation, but in essence, it is the cost of the asset, minus its salvage value, divided by its useful lifetime.

You will need two key pieces of information to calculate depreciation:

- The salvage value of the asset. This is the highest price you can sell the asset for at the end of its useful life.

- The useful lifetime of the asset. This is the period of time during which the asset can still viably be used for its intended purpose.

As an example, if an asset has a useful lifetime of 10 years, a cost of $5,000 and a salvage value of $2,000, its annual depreciation is ($5,000 – $2000) / 10 = $300.

For accounting purposes, depreciation is calculated from the first year that the asset is “placed in service” (i.e. put into use).

If an asset is purchased mid-year, its depreciation is calculated monthly until the end of the first accounting year.

What is Meant by Accumulated Depreciation?

The depreciation of an asset is calculated at the beginning of its useful life. The accumulated depreciation gives the asset’s value at any point during the lifetime. This is important in allowing a business to accurately report the value of its assets.

We have looked in previous articles at how expenses and sales must balance in accounting. Accumulated depreciation is the manner in which this balance is achieved for capitalised assets (assets which provide a business value for a period of more than one year). To maintain balance, a proportion of the asset’s cost is reported as a depreciation expense. Accumulated depreciation is simply the amount by which the asset has been depreciated in value at a point in time.

Calculating Depreciation – the Three Main Methods.

There are two ways to calculate monthly depreciation. For either method you must first know the asset’s useful lifetime. This is typically within a range defined by the IRS. For example, personal property can have a useful lifetime of between three and 20 years. Improvements to land fall between 15 and 20 years. Residential real estate is fixed at 27.5 years and business real estate at 39 years.

These figures are derived from the Modified Accelerated Cost Recovery System (MARCS).

METHOD 1 – STRAIGHT-LINE DEPRECIATION

Straight-line depreciation reduces the value of an asset by an equal amount each year. It is calculated by subtracting the salvage value from the cost and dividing this figure by the useful lifetime in years (and further dividing by 12 to arrive at a monthly depreciation figure).

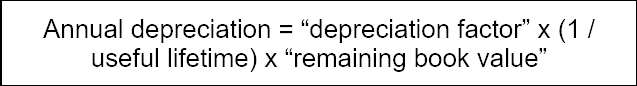

METHOD 2 – DECLINING BALANCE

In “real life” most of an asset’s depreciation occurs early in its useful lifetime, and the declining balance method reflects this.

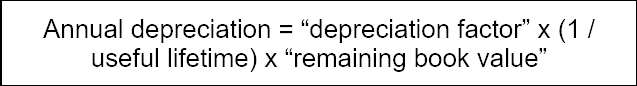

Declining balance is subdivided into “double-declining balance” and “150% declining balance”. Whichever of these ways is used, the depreciation amount will change from year to year, so the calculations required are somewhat more complex. The calculation for double-declining balance is as follows:

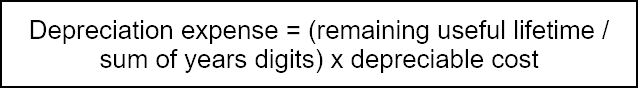

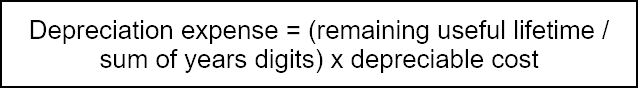

METHOD 3 – SUM-OF-YEARS’-DIGITS

METHOD 3 – SUM-OF-YEARS’-DIGITS

Sum-of-years’-digits (SYD) is an accelerated way of determining depreciation. Literally, the number of years in the asset’s useful lifetime are summed together – so if the lifetime is five years the sum would be 5+4+3+2+1 = 15. Each year digit is then divided by 15 to calculate the depreciated percentage, with the highest proportion depreciated in the first year and so on.

The calculation for SYD is:

Billwaze

Billwaze

METHOD 3 – SUM-OF-YEARS’-DIGITS

Sum-of-years’-digits (SYD) is an accelerated way of determining depreciation. Literally, the number of years in the asset’s useful lifetime are summed together – so if the lifetime is five years the sum would be 5+4+3+2+1 = 15. Each year digit is then divided by 15 to calculate the depreciated percentage, with the highest proportion depreciated in the first year and so on.

The calculation for SYD is:

METHOD 3 – SUM-OF-YEARS’-DIGITS

Sum-of-years’-digits (SYD) is an accelerated way of determining depreciation. Literally, the number of years in the asset’s useful lifetime are summed together – so if the lifetime is five years the sum would be 5+4+3+2+1 = 15. Each year digit is then divided by 15 to calculate the depreciated percentage, with the highest proportion depreciated in the first year and so on.

The calculation for SYD is: