When you want to know the financial position of your business at a specific point in time, a balance sheet is the document you need.

A balance sheet is a record of a business’s assets, liabilities and its shareholders’ equity on a given day. It’s a top-level view of the total amount your business owns, and what it owes. It also shows how much is invested by the owners.

What does a Balance Sheet Show?

A balance sheet comprises elements which can be used to determine the financial position of a business: its shareholder equity, liability and assets. It comprises these key elements:

ASSETS

Current assets are those that can be converted to cash within a year. On the balance sheet they are subdivided into:

- Cash and cash equivalents. The most liquid form of assets, this includes checking and savings account balances, currency, and checks

- Accounts receivable. The balance owed to a business by its clients for products and services (due for payment in the short term)

- Inventory. This includes both raw materials and finished products for businesses that make or sell items.

- Prepaid expenses. These are items paid in advance, such as insurances and rent.

Long term assets, as you might expect, are those assets which will not be converted to cash within a year, These are further divided into:

- Fixed assets. Property and buildings, hardware such as computers, and machinery are all forms of fixed asset.

- Long term securities. This describes investments which cannot be liquidised within a year.

- Intangible assets. These non-physical assets such as intellectual property, copyrights, patents and franchise agreements.

LIABILITIES

After assets on the balance sheet, come liabilities. This is a record of the debts your business owes to others, such as loan repayments and other recurring expenses. Just like assets, liabilities are subdivided into:

Current liabilities. These include things like:

- Payroll

- Taxes

- Interest payments

- Rent and utilities

Long term liabilities, comprised of:

- Pension fund liabilities

- Deferred income taxes

- Long term loans

SHAREHOLDER EQUITY

Shareholder equity is the value of a business’s total assets minus their total liabilities. It is the amount of money generated by the business, plus any money invested by the owners or shareholders and all donated capital.

How do I Balance a Balance Sheet?

Just like other aspects of bookkeeping, your balance sheet must balance.

The two “sides” of your balance sheet represent the total value of all your assets, and the total value of all your liabilities and shareholder equity. One side must always be equal to the other.

What is the Importance of a Balance Sheet?

On its own, a balance sheet gives an overview of the financial status of your business on a given day. When looked at along with other financial statements it also helps to understand the relationship between different accounts.

The following information can be derived from a balance sheet:

EFFICIENCY

A comparison of your income statement and your balance sheet will give you insights into how efficiently your assets are being used, and how your assets are used to create income.

LEVERAGE

Leverage describes how your business is positioned with regards to financial risk. Comparing your total debt to your total equity will help you see how much risk your business faces.

LIQUIDITY

Liquidity, or how much cash you have on hand, is vital in understanding whether you can meet your current financial obligations. Ensuring that your assets exceed your liabilities means that your business is in a healthy position with regards to these debts.

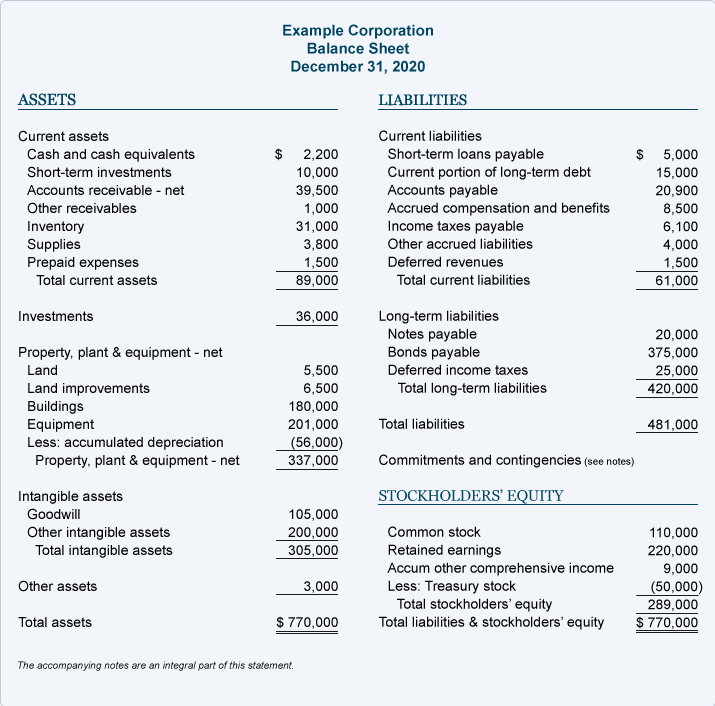

Looking at a Balance Sheet

Here’s an example of a balance sheet as it would look in real life:

Understanding Balance Sheets

Source: https://www.accountingcoach.com/balance-sheet-new/explanation/2

You can clearly see how the assets on one side, and the liabilities and shareholder equity on the other, balance each other out exactly.

The Four Key Financial Statements

Understanding the exact financial status of a business is a complex affair, and cannot be done with one report alone. To gain an accurate picture of the health of a business, four main statements are combined. These are:

BALANCE SHEET

As we have seen in this article, the balance sheet details the relationship between a business’s total assets and total liabilities, plus shareholder equity. It reveals important data such as the business’s liquidity and is used to derive the theoretical monetary value of the business.

CASH FLOW STATEMENT

The cash flow statement is where a business records money coming into and out of a business over a defined period of time.

STATEMENT OF RETAINED EARNINGS

In this report you will find details of the changes in a business’s equity over a period of time. It details things such as the sale and repurchase of stock, dividend payments and changes derived from the reporting of profits and losses.

INCOME STATEMENT

Considered the most important statement, as the income statement is where a business’s generated profits are found. The statement covers revenues, expenses and profits/losses over a defined period of time.

Billwaze

Billwaze