Manufacturing overhead costs are all the indirect factory expenses associated with the manufacture of a product. Calculating manufacturing overhead involves adding together costs such as indirect materials, plant repair, indirect labor costs, insurance, factory supplies, depreciation, utilities.

Manufacturing overhead is sometimes referred to as factory overheads or manufacturing support costs. Whichever term you hear, it’s important to realize that more general overheads such as marketing and administration are not included.

What Constitutes Manufacturing Overhead Costs?

The cost of manufacturing a product includes more than simply raw materials and direct labor. There are many other expenses which must be accounted for. These include:

● Factory utilities

● Factory supplies not used directly in manufacture

● Property tax and building rent

● Salaries of manufacturing staff, management team, material handlers, etc.

● Depreciation of equipment

● Insurances

● Computers and communications equipment

All of the above cost items are indirectly related to the manufacturer of goods and so are considered to be manufacturing overhead costs.

How do You Calculate Manufacturing Overhead Costs?

STEP 1 – CALCULATE THE TOTAL OVERHEAD

To do this, identify all the indirect costs associated with the production of your goods, and add them together.

STEP 2 – CALCULATE THE OVERHEAD RATE

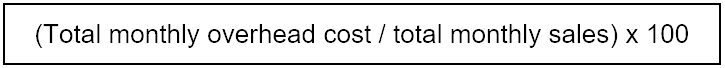

The overhead rate is the percentage you will pay for overheads each month. The calculation to determine the overhead rate is as follows:

For example, a business with $50,000 monthly manufacturing overhead cost and $400,000 monthly sales would calculate their overhead rate by dividing $50,000 by $400,000 to get 0.125, and multiplying by 100 to get an overhead rate of 12.5%.

This rate tells us that 12.5% of the business’s monthly sales revenue will be needed to cover their manufacturing overhead costs.

A low overhead rate suggests that a business is using their resources efficiently. Conversely, a higher than average rate would suggest that there are opportunities for cost savings. For this reason, knowing your manufacturing overhead rate is a useful tool in budgeting.

Accounting for Manufacturing Overhead

The standards of practice set out by Generally Accepted Accounting Principles (GAAP) manufacturing overheads need to be added to direct labor and materials costs to produce the cost of goods sold and the inventory value.

These costs are factored into the valuation of both finished goods and work in progress; and both COGS and the inventory value must appear on your balance sheet and income statement.

Calculating Allocated Manufacturing Overhead

So far we have looked at generating a total manufacturing overhead. However, GAAP practices state that in order to be fully compliant a manufacturer’s financial statements should allot a portion of the overhead to each item produced.

After following the steps above to calculate the overhead rate, you can proceed to determine the allocated rate as follows:

STEP 1 – DETERMINE THE ALLOCATION BASE

This is the basis upon which you will assign portions of the total overhead to specific products. “Direct machine hours” and “direct labor hours” are two common ways to arrive at the allocation base.

STEP 2 – DIVIDE TOTAL MANUFACTURING OVERHEAD BY ALLOCATION BASE

This will tell you how much of the total overhead to allocate to each product.

STEP 3 – CALCULATE THE ALLOCATION TOTAL

Divide the allocation base by the number of units manufactured to arrive at a final “per unit” manufacturing overhead cost.

Allocating manufacturing overhead is vital to determine accurate overhead costs for each unit produced.

When running a manufacturing business, manufacturing overhead cost is a critical metric that will allow you to better understand how efficiently your business is performing and where you may be able to make cost savings.

Billwaze

Billwaze