Billwaze

Billwaze

Jeff Liebov is the CEO & Founder of BILLWAZE. Jeff envisioned a simpler way out of the complicated world of accounting apps and created BILLWAZE. As a tool, BILLWAZE makes things easy for those who want to get things done fast, without all the hassle. Jeff and the team are continuously improving the platform and are passionate about making the entire billing process simpler than ever.

Relevant Blog

How To Navigate Overdue Invoices

Published on April 10, 2023 by Stephanie MilneAs a conscientious small business, you work tirelessly to deliver your products or services to your customers on time so, when invoice deadlines pass without payment being received, it’s frustrating. But overdue invoices aren’t simply an inconvenience; when clients don’t pay by the due date, your business’s cashflow can suffer. It becomes harder to settle […]

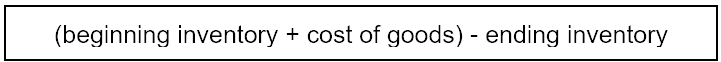

In this formula, “beginning inventory” is the value of inventory and the start of the reporting year (which is in fact calculated at the end of year before). “Cost of goods”, as you may expect, is the cost of all goods purchased or produced through the year. “Ending inventory” is defined as the value of all inventory at the end of the year.

FORMULA 2

In the second method, any change in inventory is used to adjust the Cost of Goods. Let’s look at an example:

At the start of the year, Bob’s Hardware Store places an order for 100 ladders. By the end of the year, Bob’s inventory has increased by 20 ladders. In this case, the cost of 480 ladders is the Cost of Goods Sold.

Had Bob’s inventory fallen by 30 ladders at the end of the year, then the cost of 130 ladders would be the Cost of Goods Sold.

Other Uses for COGS

When a business wants to determine its inventory turnover (the number of times they sell or replace their inventory in a given period) COGS can be used for this purpose. It is sometimes also used to determine gross margin.

Variable Inventory Cost and COGS

With so many factors involved in determining the Cost of Goods Sold, it’s no surprise that it is not a number that remains static over the course of a year. In order to accurately report COGS, these fluctuations need to be accounted for, and there are three ways to do this:

In this formula, “beginning inventory” is the value of inventory and the start of the reporting year (which is in fact calculated at the end of year before). “Cost of goods”, as you may expect, is the cost of all goods purchased or produced through the year. “Ending inventory” is defined as the value of all inventory at the end of the year.

FORMULA 2

In the second method, any change in inventory is used to adjust the Cost of Goods. Let’s look at an example:

At the start of the year, Bob’s Hardware Store places an order for 100 ladders. By the end of the year, Bob’s inventory has increased by 20 ladders. In this case, the cost of 480 ladders is the Cost of Goods Sold.

Had Bob’s inventory fallen by 30 ladders at the end of the year, then the cost of 130 ladders would be the Cost of Goods Sold.

Other Uses for COGS

When a business wants to determine its inventory turnover (the number of times they sell or replace their inventory in a given period) COGS can be used for this purpose. It is sometimes also used to determine gross margin.

Variable Inventory Cost and COGS

With so many factors involved in determining the Cost of Goods Sold, it’s no surprise that it is not a number that remains static over the course of a year. In order to accurately report COGS, these fluctuations need to be accounted for, and there are three ways to do this: