An income statement is one of the four most important financial statements a business must issue. In addition to the cash flow statement, balance sheet and statement of retained earnings it provides a vital overview of the financial health of the business.

In order to prepare an income statement there are a number of key metrics that need to be brought together, including revenue, cost of goods sold, gross margin, expenses, income, and taxes.

In this article we will look at how to organize these figures correctly so that your income statement gives the truest picture of the status of your business.

Determine Your Reporting Period

Ordinarily, businesses will prepare their income statement on a monthly, quarterly or annual basis. If your business is publicly traded, then quarterly and annual statements are a requirement. For smaller businesses this isn’t the case – however, creating monthly income statements is a great way to monitor your financial performance and spot patterns in your profits and expenditure, helping you to run your business at maximum efficiency and profitability.

Create a Trial Balance Report

Your trial balance report will give you all the figures you need to prepare your income report. A trial balance report is a summary of all your account balances for any given reporting period.

Calculate Revenue

For the purposes of an income statement, your revenue consists of all money you have earned from your products and services, regardless of whether payment has been made or is still outstanding. All your revenue will appear on your trial balance report, so simply add up all the revenue items and enter them into your income statement (we’ll show you an example of an income statement later in the article so you can see how it all fits together).

Cost of Goods Sold

Cost of Goods Sold is made up of the direct labor, materials and overheads associated with the purchase or manufacture of the products and services you sell. Calculate this figure, and add it to your income statement next.

The revenue you have generated from sales of goods and services, minus the cost of goods figure, will give you your gross margin for the reporting period.

Factor in Your Operating Expenses

Again, your operating expenses will be detailed in your trial balance report. For the income statement you need one total figure, so add up the individual expenses and include them in your statement.

Determine Your Income

Now that you know your operating expenses, you can subtract them from your gross margin figure to arrive at your income for the reporting period.

Income Tax

Your income tax figure will depend on your income (of course!) and the particular tax rates in the state you operate in. Multiply that rate by your income to arrive at your income tax liability.

Determine Your Net Income

The final figure required for your income statement is your net income. This is determined by subtracting your income tax from your pre-tax income figure, and is entered as the final line on your income statement.

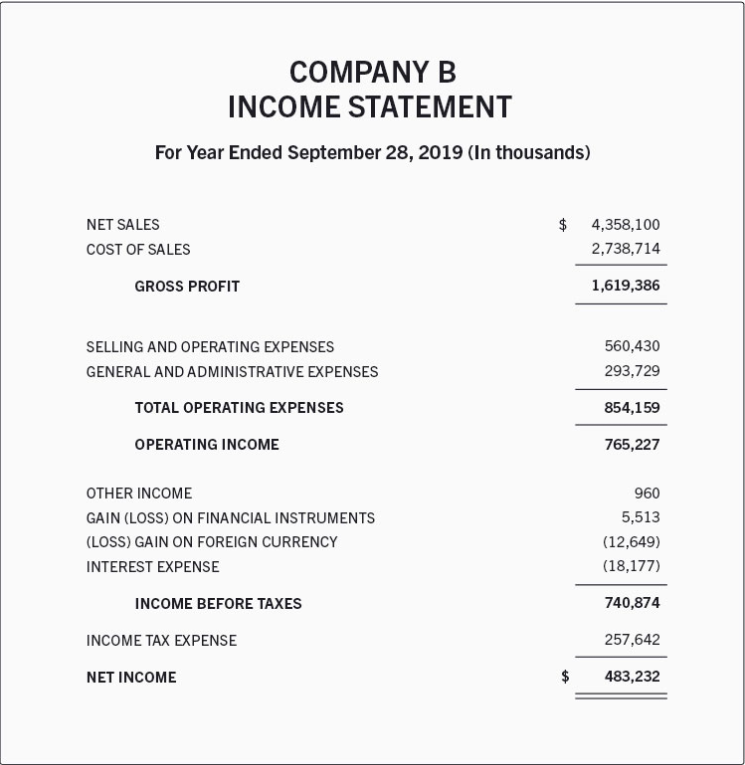

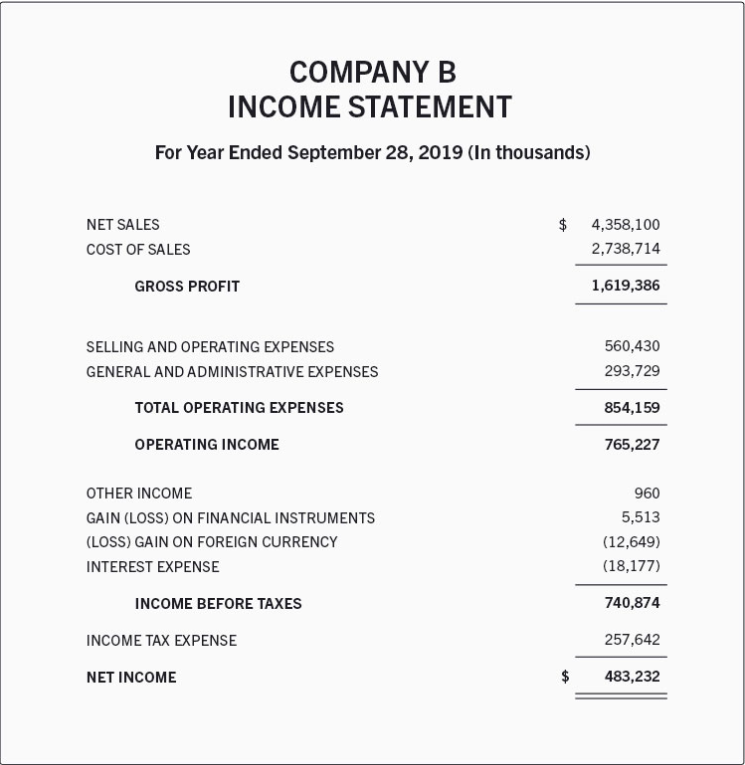

Example Income Statement

Once you have entered all the relevant figures into your income statement, and added information like your business details and reporting period, it should look a lot like this:

Source: https://online.hbs.edu/blog/post/income-statement-analysis

Income Statement Vs Balance Sheet – What’s the Difference?

While they are both very important, there are several significant differences between an invoice statement and a balance sheet.

For starters, a balance sheet gives an overview of financial performance at a specific point in time, whereas the income statement looks at a (usually monthly,

quarterly or annual) window of time.

In addition, while the balance sheet details a business’s assets, liabilities and equity, the income statement is used to report on their revenue, expenses and profit or loss.

Perhaps most notably, however, the income statement is used to report on the business’s overall financial performance, as opposed to the balance sheet which deals more specifically with the business’s ability to meet its financial obligations with liquid assets.

Billwaze

Billwaze